Recently, a report revealed that Indian banks witnessed their highest hiring numbers in a decade in FY23, and this trend is expected to continue in FY24, with top officials predicting an increase in headcount growth.

However, along with this significant increase in hiring efforts come major challenges that directly impact the sector’s growth and efficiency, making talent acquisition a serious pain point for the banking industry.

These recruitment challenges, ranging from a lack of skilled candidates to high turnover rates, have significant implications that certainly cannot be overlooked.

Ready to explore these challenges in detail and discover effective strategies to overcome them?

Let’s get started!

Top 7 recruitment challenges in the banking industry

It is crucial for hiring teams to identify issues in their recruitment process before they spill over and lead to a ripple effect, impacting an organization’s overall functioning and success.

Here’s a look at the top 7 hiring challenges in the banking industry:

1. Lack of skilled candidates

As scary as it sounds, 87% of companies globally are aware that they either already have a skills gap or will have one within a few years!

This challenge is especially pronounced in the banking sector, with its considerable dependence on advanced technology in recent years.

We’re in the age of digital banking, where most banking services have gone into self-service mode, and the lack of technically proficient employees is a major challenge.

In the same vein, there is a noticeable gap in the education and training of banking professionals.

The role of banking professionals has evolved beyond basic functions, now demanding knowledge in areas such as data analytics, cybersecurity, and digital customer service.

This lack of skilled candidates therefore, leads to roadblocks in implementing new tech, reduced operational efficiency, and increased security risks.

2. High turnover rates

High turnover rates are a major challenge for organizations in any industry.

Considering the already high levels of skills gap and its implications on the banking industry, the struggle is real as employees don’t possess the skill set to carry out their responsibilities!

Here’s a concerning figure – about 37% of financial advisors plan to retire during the next decade, and 72% of newcomers (with 3 or fewer years of experience) fail to stay in the industry.

Matters related to compensation, growth opportunities, high levels of stress from workload, and the skills gap all contribute to these high turnover rates.

And the outcome of this? A never-ending cycle of recruitment and training, which drains the organization’s resources and affects the overall productivity.

3. Candidate fraud

Security in the banking sector takes precedence, and any risk can cost the organization a hefty sum!

A study found that the banking, financial services, insurance, ecommerce, and staffing sectors were the most susceptible to employment fraud, with nearly 8% of employees failing background verification checks!

It is a major challenge for recruiters to identify such serious security threats. Therefore, it is imperative for strong background verification (BGV) measures to be in place.

Ensuring thorough screening processes, leveraging advanced verification technologies, and conducting regular audits can help decrease the risk of candidate fraud.

4. High competition for top talent

Every recruitment challenge in the banking sector sets off a chain reaction, resulting in more challenges for recruiters to overcome. Sounds exhausting, doesn’t it?

The skills gap and high turnover rates lead to high competition in the banking industry for top talent.

Additionally, the fact that top talent is quickly hired makes recruitment in the banking sector particularly challenging.

With the increased demand for tech skills and knowledge across industries, fintech companies prove to be tough competitors for highly skilled top talent.

To attract top talent, banks must offer compelling employee value propositions (EVP), including career growth opportunities, attractive compensation packages, and promote a positive work environment and company culture.

5. Poor candidate experience

What’s worse than missing out on a high-caliber candidate? Providing them with a subpar candidate experience and thereby tarnishing your employer brand.

Did you know that 49% of job seekers have declined an offer because of a poor candidate experience? This is too risky to take lightly!

This is a major and common problem in recruitment across industries. In the banking sector, where the stakes are really high, poor candidate experience can lead to missed opportunities for securing top talent.

Ensuring a seamless, transparent, and engaging recruitment process is important to maintain a strong employer brand and attract the A-list and trustworthy candidates who are highly skilled.

6. Long and manual hiring processes

This is one of the major contributors to poor candidate and recruiter experience, and it’s essential to keep both parties happy.

Not just that, the way and speed at which you carry out your recruitment process directly impacts the organization’s operational efficiency and reputation.

Long and manual hiring processes steal precious recruiter time. This leaves them juggling countless responsibilities and with little time for personalized candidate engagement.

This not only leads to recruiter burnout but also negatively impacts the candidate experience. A lengthy recruitment process will deter candidates from considering you as an employer of choice.

In fact, 40% of candidates expect it to take no longer than six days after applying for a job to arrange an interview. If providing a positive candidate experience and not losing out on top candidates is your priority, it’s your responsibility to increase the pace of your hiring process!

7. Diversity hiring

If you are already struggling to fill positions with top talent, consider this: more than 3 in 4 employees and job seekers (76%) report that a diverse workforce is an important factor when evaluating companies and job offers.

It therefore goes without saying – your next steps must include formulating and implementing effective diversity hiring strategies.

Promoting diversity not only enhances organizational culture but also brings in fresh perspectives into the organization and drives innovation and better decision-making.

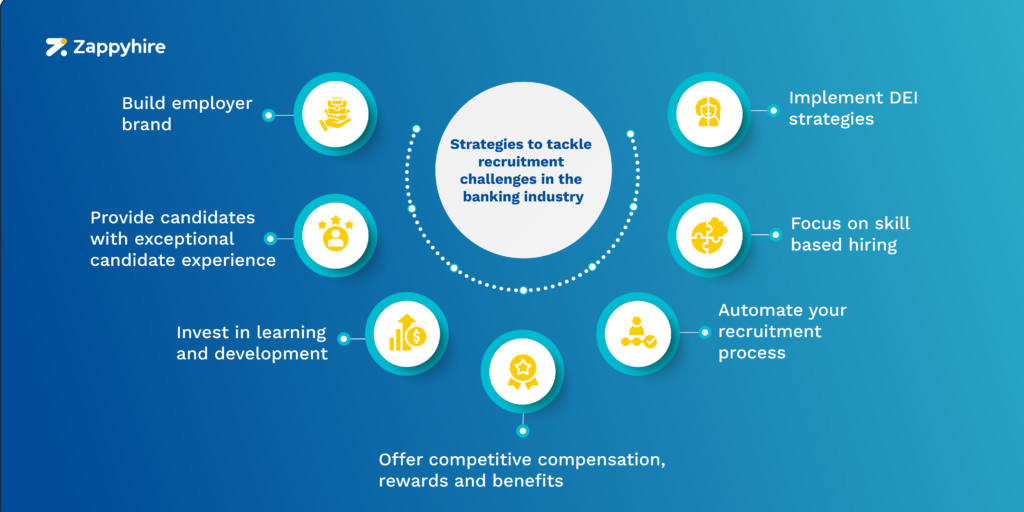

Strategies to overcome recruitment challenges in the banking industry

We’ve explored the seven major challenges that recruiters face in the banking industry, and we won’t lie – these cannot be taken lightly!

But here’s the good news: identifying and defining the challenges is half the battle won!

As for the other half, let’s dive into the strategies to overcome them. Here are 7 strategies to tackle the recruitment challenges that plague the banking industry:

1. Build employer brand

The impression your prospective candidates have about your organization can play a major role in their decision to consider applying or accepting job offers, as well as in retaining and engaging employees.

Boosting your employer brand is also crucial for attracting and impressing passive candidates – those highly skilled individuals who are not actively seeking job opportunities.

Plus, competition won’t be too high for them since they aren’t officially in the market!

Not sure where to start when it comes to building your employer brand? Check out our blog, “Employer Branding Strategy | What it is and How to Build One”.

2. Provide candidates with exceptional candidate experience

A survey by CareerPlug showed that 81% of candidates said a positive candidate experience influenced their decision to accept an offer.

When it’s already hard to attract and hire candidates in an industry such as banking, hitting the mark with the candidate experience can get you one step closer to the talent you are seeking.

Ensuring short hiring timelines, prompt responses, constant updates regarding the application, and personalized communication, can all go a long way.

For more on the ABCs of how to provide exceptional candidate experience to your candidates, check out our eBook, “A Guide to Exceptional Candidate Experience”.

3. Invest in learning and development

Let’s be frank – learning never stops. There are always new developments, discoveries, technologies, concepts, strategies, and more just waiting to be explored.

With the skills gap being one of the most pressing challenges in the banking industry, it is crucial to address it with learning and development programs.

Invest in training sessions, sponsor certificate courses, and offer reimbursement for professional development.

This commitment to continuous learning will not only bridge the skills gap but also enhance employee satisfaction and retention.

4. Offer competitive compensation, rewards, and benefits

We’ve already acknowledged the fact that there is high and tough competition to win over talent in the banking sector.

So, what can you do to win this race? Make your candidates an offer they cannot refuse – competitive compensation, rewards, and benefits.

Pay packages and perks tend to be the deciding factor when candidates are choosing which offer to take up.

Offering compensation that meets or exceeds industry standards, comprehensive benefits packages, performance bonuses, and opportunities for career advancement can make your organization more appealing to prospective employees.

5. Automate your recruitment process

Wondering what a surefire way to improve candidate experience, engage the right talent, and enhance overall recruitment efficiency is?

A recruitment automation software can automate the cumbersome manual and repetitive tasks that recruiters must deal with.

This expedites your hiring process, streamlines operations, and allows for a more personalized approach to communication and engagement.

Considering the long and manual processes prevalent in the banking industry, opting for a recruitment automation tool like Zappyhire can be transformative.

Zappyhire offers an array of impressive features such as:

- A multilingual recruiting chatbot

- A semantic resume parser

- AI assessments

- An Automated Video Interviewing tool

… And a lot more highly advanced features, making your hiring process a treat for all stakeholders involved. With these tools, top candidates are at your fingertips in no time!

6. Focus on skill-based hiring

Guess what? Only 16% of new hires possess the skills needed for their roles!

No wonder the skills gap has been cited as a major challenge for recruiters in the banking sector.

Skills-based hiring is the way forward and for good reason too! Skills-based hiring is a recruitment strategy that prioritizes skills and competencies over qualifications such as degrees or years of experience.

When the end goal is to get the job done and to be good at it, why focus on things that may not necessarily contribute to the role and the responsibilities that come along?

This approach results in a broader talent pool, a better job fit, improved performance, lower turnover rates, and enhanced diversity, equity, and inclusion (DEI).

Conducting skill-based assessments is an effective way to identify top candidates as they help highlight the candidate’s skills and potential necessary for the job role.

7. Implement DEI strategies

83% of Gen Z candidates consider a company’s commitment to diversity and inclusion important when choosing where to work.

And guess what? Gen Z will make up 27% of the workforce by 2025!

Ensuring DEI in the workplace is crucial in the banking sector, where diverse perspectives can drive innovation and better customer service.

Implementing DEI strategies involves tracking and analyzing hiring metrics to identify biases, providing diversity training, opting for recruitment automation tools to minimize bias, promoting flexible work arrangements, and fostering an inclusive company culture.

By prioritizing DEI, banks can not only attract a wider candidate pool, but also improve employee satisfaction and retention.

To sum up…

Each organization is unique, so the challenges that surface aren’t universal. To effectively solve these issues, strategies must also be tailor-made as there really isn’t a one-size-fits-all solution.

Zappyhire has been designed to solve recruitment problems faced by recruiters in the banking industry. Book a call with us today to understand how we can ease your hiring troubles!